Artificial intelligence and the vast effort to decarbonize industrialized nations has left the world at the start of a new economic ‘super cycle’ that could drive growth for decades to come.

The eye-opening claim was made by Peter Oppenheimer, the head of macro research Europe at Goldman Sachs, who said today’s groundbreaking technology could rival the impact of the steam engine or electrification.

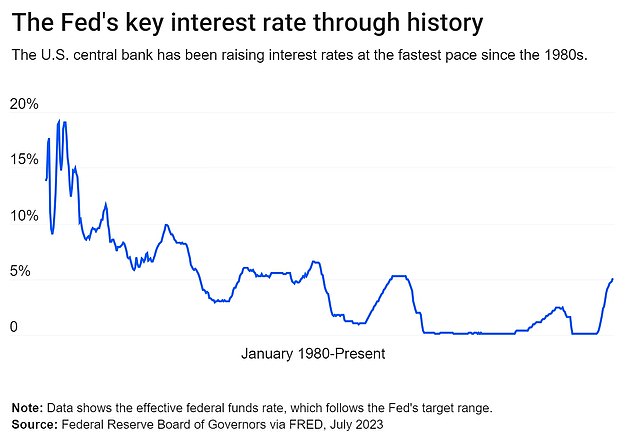

And he compared the outlook to that at the start of the 1980s when falling inflation and interest rates combined with a wave of deregulation to trigger the start of the last super cycle.

But he warned that the stability of that era has disappeared, with international conflict and resistance to globalization threatening to rob the world of the prize in its grasp.

‘We are moving clearly into a different super cycle,’ he told CNBC’s Squawk Box Europe on Monday.

Peter Oppenheimer told CNBC that the advent of AI combined with the multi-trillion dollar cost of decarbonization will disrupt the economy in a way not seen for decades

‘What I think we will see a lot of in time is new applications in services which are really based off these new technologies, and that’s really when you tend to get the positive impacts coming through,’ he added

Interest rates plummeted at the start of the 1980s helping kick start the last super cycle

‘Because of this tremendous twin shock that we’re likely to see, positive shock of technological innovation at a very rapid pace together with restructuring of economies to move towards decarbonization, I think that’s a period that’s more akin really to what we saw in the late 19th century.’

The World Economic Forum has estimated that 83 million jobs will disappear worldwide in the next five years alone as AI cuts a swathe through clerical roles.

And the cost of decarbonization is likely to reach $110 trillion, or 1.3 percent of projected global GDP over the next 30 years, according to the Energy Transitions Commission.

But both are likely to create millions more new jobs and radically improve productivity, according to Oppenheimer.

‘We are in the relatively early stages, we’re in the innovation stage where the technologies are commercializing and becoming leverageable.

‘But what we have not seen and I think we will see a lot of in time is new applications in services which are really based off these new technologies, and that’s really when you tend to get the positive impacts coming through and the broadening out of its effect across the equity market.’

The impact of the Covid-19 pandemic took a sledgehammer to globalization with supply line bottlenecks and increased pressure across the world for less dependence on international trade.

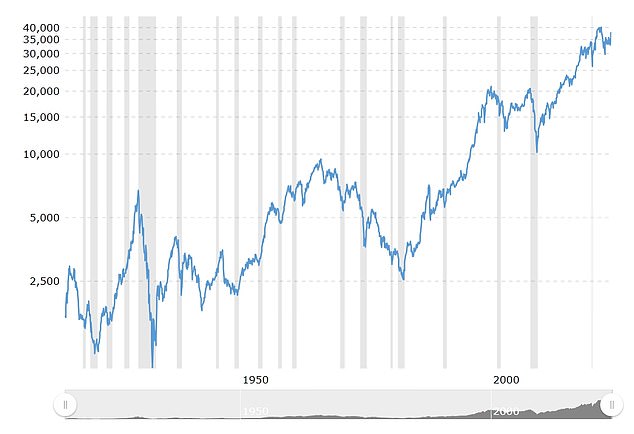

The Dow Jones Industrial Average soared from little over 2,500 in June 1982 to more than 37,000 today

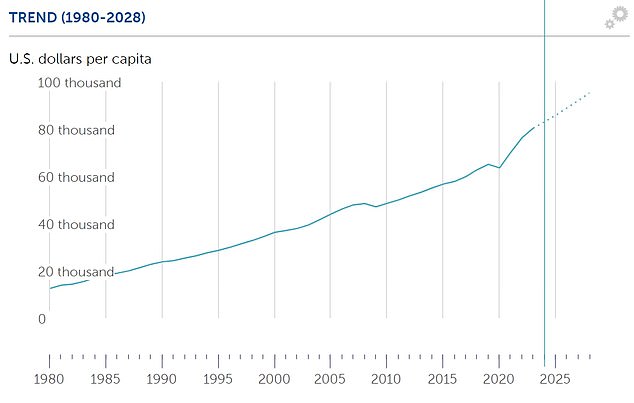

And it helped more than quadruple US GDP per head to more than $80,000

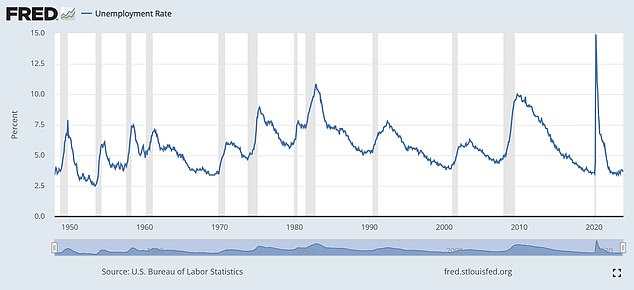

Meanwhile unemployment has returned to a 50-year low after spiking during the pandemic

Continuing tension with China, and wars in Ukraine and Gaza have also dampened optimism about the world economy in recent months.

‘The major super cycle that we’ve been in really started in the early 1980s when interest rates and inflation peaked at very high levels and we saw 25 or 30 years of consistently falling inflation and cost of capital,’ Oppenheimer said.

‘That period was also supported by very aggressive supply side reforms, privatization, deregulation lower corporate taxes, the collapse of the Berlin Wall and the Soviet Union bringing down global risk premia and of course the move towards globalization.

‘Those factors can no longer be relied on in the same way, we’re not likely to see interest rates trending down as aggressively over the next decade.

‘We’re seeing some pushback to globalization and of course we’re seeing increased geopolitical tensions.’

A study by job site Indeed in September found that software engineers, lawyers, accountants, journalists and bankers are facing the most immediate threat from artificial intelligence, while truck drivers, nurses, cooks, construction workers and cleaners are the most protected.

It examined 55 million postings requiring around 2,600 different skills and asked ChatGPT to rate its own ability to perform them.

The app thought it could do a ‘good’ or ‘excellent’ job in 20 percent of the roles, while the study found a high correlation between jobs that can be done remotely and their vulnerability to AI.

And Oppenheimer believes that the surge in AI development is less vulnerable than the dot com boom of the late 1990s.

More than two thirds of jobs are highly vulnerable to AI, according to study by Indeed which examined 55 million postings between August 2022 and July 2023

The skills that ChatGPT felt most capable of mastering include: software development, IT, math, legal, accounting, HR and media

‘We have seen some tremendous gains in some of the companies which are at the epicenter of these technologies,’ he added.

‘But they’re not really that expensively valued when you compare them for example to the dominant companies during the tech bubble or the Japanese bubble in the late 1980s, and they’re already more profitable.

‘Looking back in time, cycles and structural breaks do repeat themselves but never in exactly the same way.

‘And I think we need to sort of learn from history what are the inferences that we can look at in order to position best for the sort of environment we’re moving into.’

By Daily Mail Online, January 8, 2024